- February 24, 2021

- Posted by: FSAdmin

- Category: Hoja de Ruta Commodities

On 10 December 2019, Alberto Fernández was sworn in as the President of Argentina, replacing Mauricio Macri. The new government has mainly focused its policy efforts on addressing the economic crisis that pre-dates the pandemic but has been exacerbated by it, putting further climate policy developments into jeopardy. The recovery measures taken by the government as of June 2020 aim to protect the oil and gas industry from collapsing prices and demand, while ‘green’ recovery measures remain largely absent in current proposals. The CAT rates Argentina as “Critically insufficient”.

We expect that GHG emissions in 2020 will be 7%–9% lower than 2019. Argentina faces the economic crisis induced by the COVID-19 pandemic amid a changing government and an economic recession for the second consecutive year. The country’s energy sector and climate change planning will be largely influenced by the ongoing developments of the pandemic, the domestic recovery measures to confront the crisis, the external risks due to the collapse of international oil prices, and the renegotiation of its foreign debt.

The government has not introduced any ‘green’ measures in its recovery stimulus plans but instead artificially fixed the domestic oil price at a minimum of USD 45 per barrel for 2020, irrespectively of the fact that international oil prices remain considerably lower. Although the new government has justified this intervention to protect jobs and the entire energy industry in the context of the COVID‑19 crisis, this measure constitutes a direct subsidy to rescue the oil and gas sector in Argentina. The government also capped electricity and gas tariffs to December 2019 levels until the end of 2020.

Argentina has centred its energy sector strategy around the exploitation of abundant gas reserves in the “Vaca Muerta” formation as a source of cheap oil and gas for national consumption and exports (see our analysis of current policies). The strategy’s implementation potentially endangers the expansion of renewable energy in the Argentinian power sector and might lock end-use sectors into carbon-intensive pathways, leading to subsequently higher GHG emissions and increasing the risks of stranded assets. The CAT cautioned in June 2017 that natural gas has a limited role to play as a bridging fuel in the power sector globally, and runs the risk of overshooting the Paris Agreement long-term temperature goal and creating stranded assets.

Programmes and climate change legislation processes previously initiated by the Macri administration, such as the RenovAr programme or the NDC revision and Long-Term Strategy (LTS) processes, may be subject to change. Their progress might be particularly affected by administrative restructuring in the technical teams working on climate issues in the respective ministries and secretariats. For example, the Energy Secretariat has already been restructured by merging the former Renewable Energy Sub-Secretariat into a broader Power Energy Sub-Secretariat.

In July 2019, the Macri government declared a climate emergency followed by the Senate passing a Climate Change Law in December 2019. The law positioned the treatment of climate change as national policy, institutionalised the articulation of activities and responsibilities related to climate change, and established minimum financial budgets for its adequate management, including the design and implementation of mitigation and adaptation policies. Macri announced the goal of achieving carbon neutrality by 2050. However, the recent change in government brings uncertainty around the implementation of these policies.

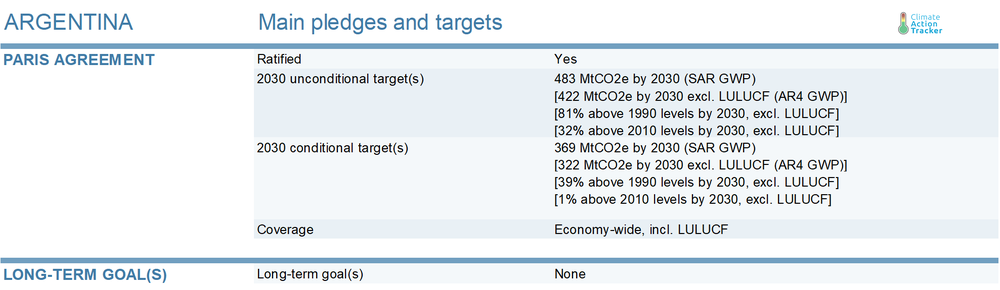

The CAT’s Argentina current policies emissions projections are 5%–9% lower in 2030 compared to our previous projections in December 2019, mainly due to the impact of the pandemic on 2020 emissions and the revised historical emissions with lower emissions in the base year. The CAT rates Argentina’s target under the Paris Agreement “Critically insufficient”, as it is not stringent enough to limit warming to 2°C, let alone 1.5 ̊C.

Current policy projections

Against the backdrop of an economic crisis that began in 2018 and exacerbated by the pandemic, the incoming government undertook a series of changes in the structure of its ministries to decrease government spending and setting priorities in line with the new administration’s agenda. On the one hand, the Secretariat of Energy dismantled the Sub-Secretariat of Renewables and the former Sub-Secretariat of Hydrocarbons was upgraded to a secretariat, indicating the government’s priority in oil and gas exploitation over the development of renewables in the energy sector. On the other hand, both the former Secretariat of Agriculture and Secretariat of Environment took up ministerial ranks again, with a Secretariat of Climate Change under the environment ministry. The impact of this administrative restructuring on climate policy remains uncertain.

Whether Argentina will achieve its unconditional NDC depends mostly on how it develops energy sector. The sector’s development will be directly affected by the economic recovery after the pandemic, the implementation of renewable energy expansion, and future energy demand. The remarkable drop in emissions in 2020 due to the pandemic will put Argentina’s projections under current policies only 2%–4% above its 2030 target. Under the additional policies scenario, if Argentina were to implement additional policies to scale-up low carbon energy sources and reduce energy demand, it could even overachieve its unconditional NDC target, with emissions 11%–13% lower than the unconditional target of 422 MtCO2e by 2030 (excl. LULUCF, in AR4 GWP).

The additional policies scenarios, which are based on energy scenarios released by the Sub-Secretariat of Energy Planning in 2019, assume an increase of Argentina’s renewable energy capacity of 12–18 GW by 2030, compared to only 4.7 GW that has been contracted under the renewable auctioning scheme RenovAr as of June 2020. The scenarios also assume further additions of nuclear capacity of 1.3 GW by 2030, although the scenarios show that investment costs for nuclear are about three times higher than the costs for renewables and gas in Argentina. Also, national projections estimate wind and solar power to be cost competitive with gas turbines before 2030.

Under current policy projections, which only consider renewable and nuclear capacity additions currently underway, Argentina will miss both its conditional and unconditional targets.

In January 2018, Argentina implemented a carbon tax covering most liquid and solid fuels sold in Argentina, based on a price of 10 USD/tCO2e. In January 2019, the tax also became operational for fuel oil, mineral coal, and petroleum coke, at 10% of the full tax rate, with an annual increase of 10 percentage points until reaching 100% in 2028. The tax is estimated to cover 20% of the country’s GHG emissions. Natural gas is exempted from the tax, as is CNG and fuel consumption in international aviation and shipping, as well as the export of these fuels.